Introduction

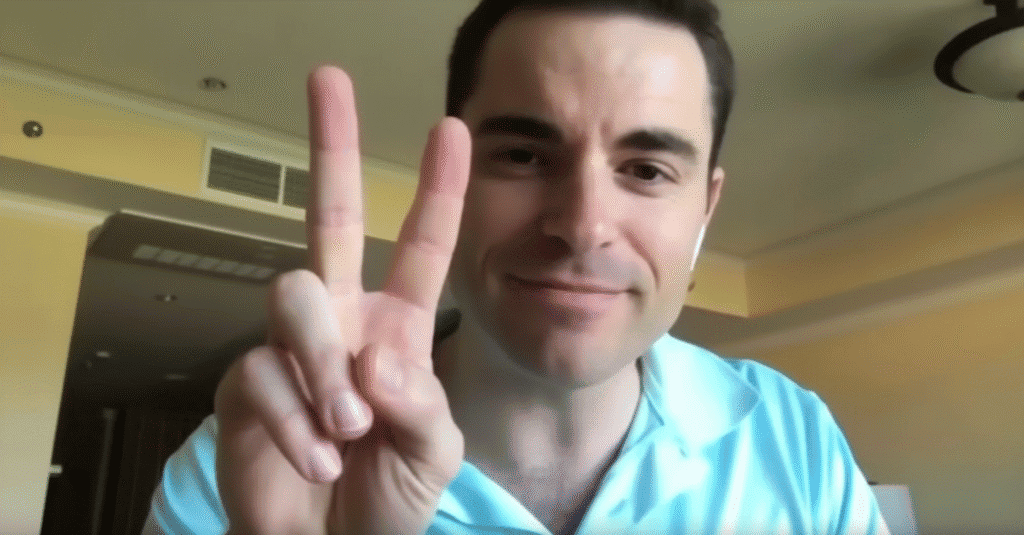

When you hear the name Roger Ver also known as Bitcoin Jesus, you probably think of early Bitcoin investments, evangelism of the asset, and the controversial fork into Bitcoin Cash. He was once affectionately or ironically called Bitcoin Jesus for his passionate advocacy for Bitcoin and later Bitcoin Cash. But behind that public persona there is now a serious legacy issue. A United States tax fraud case has ended with a settlement of nearly 50 million dollars.

-

Origins and background (2011 to 2014)

Roger Ver became one of the most visible early stage supporters of Bitcoin. He invested in core infrastructure such as wallets and payment platforms and helped promote Bitcoin worldwide. In that role he earned both admiration and criticism. In 2014, Ver made a decisive move. He gave up his United States citizenship and became a citizen of Saint Kitts and Nevis.

Under United States tax law, renouncing citizenship can trigger what is known as an “exit tax” meaning your worldwide assets are treated as if they were sold the day before you leave the country. According to reports, Ver and his companies held very large amounts of Bitcoin around 131,000 BTC at the time of expatriation.

This became the starting point of what would evolve into the tax case brought by the US authorities. -

Charges and the US case (2024)

By April 30, 2024, the situation escalated. Ver was arrested in Spain based on a United States indictment. The charges included tax evasion, mail fraud, and filing false tax returns.

The US government alleged that by underreporting his crypto holdings, failing to properly account for gains, and incorrectly valuing his assets during expatriation, Ver deprived the Internal Revenue Service IRS of roughly 48 million dollars in taxes.

His legal team responded by challenging the constitutional validity of the exit tax rules and how they were applied.

From a timing perspective, the alleged wrongdoing focused on the period from 2014, when he renounced citizenship, through 2017, when he reportedly sold significant amounts of Bitcoin. The case combined issues of crypto gains and expatriation. -

Settlement and resolution (October 2025)

In early October 2025, several news outlets reported that Ver had reached a tentative agreement with the US Department of Justice. It was a deferred prosecution agreement meaning that if he fulfilled the terms, he would avoid conviction.

Under the deal:

-

Ver agreed to pay about 48 to 50 million dollars, covering back taxes, penalties, and interest.

-

If he complied with all conditions, the indictment would be dismissed after a defined period, reportedly one month, instead of proceeding to trial.

This arrangement allowed Ver to avoid prison as long as he adhered to the terms of the deal. The final announcement made around October 14, 2025 confirmed that the Department of Justice had officially filed the deferred prosecution agreement in Los Angeles. Many observers see this as a sign of a changing enforcement approach by US authorities, favoring settlements over lengthy court battles.

What this means for crypto players

-

Tax and compliance risk are real

For anyone holding large crypto positions, especially US citizens or residents, this case is a major warning. Tax authorities take crypto gains seriously. Renouncing citizenship does not automatically eliminate tax liability. -

Reputation matters

Roger Ver’s public image as a Bitcoin pioneer meant that his case drew global attention. For crypto founders and investors, reputation and compliance are now inseparable. -

The enforcement environment is changing

While US authorities seem to be entering a slightly softer phase of enforcement in the crypto space, the tax side remains firm. Settlements may replace prosecutions, but the financial consequences are still severe. -

Planning instead of reaction

Many investors think they can deal with taxes later or that being offshore protects them. This case proves that proactive planning is far better than reactive defense. Accurate records, valuations, and professional tax advice are essential.

Takeways:

-

Document your holdings, valuations, and transactions, especially crypto.

-

If you change citizenship or move to another country, understand the full tax implications including exit tax and asset disclosure.

-

Work with tax professionals who understand crypto rather than relying on general accountants.

-

Think long term. Changing jurisdictions does not mean the tax authority stops caring.

-

Public image is not protection. Even big names can fall under scrutiny.

-

Stay informed. Regulation and taxation in crypto are evolving quickly.

Conclusion

Roger Ver’s path from Bitcoin evangelist to high profile tax defendant is a reminder of how crypto, offshore citizenship, and tax law intersect. The key message is simple: profits matter, planning matters, taxes matter. Ignoring any of them is no longer just risky. It can become a very expensive mistake.