Some of you already know Elisabeth Mühlbacher from our previous blog posts or through direct contact, but we would like to officially introduce her. With a background in art history, image science and experience in the traditional gallery world, Elisabeth now leads our initiatives in the digital art space at Validvent. She sees digital art as the defining movement of the 21st century and is helping our clients explore its cultural and financial potential.

Here is her most recent blog post, where she shares her views on the current developments in digital art.

As part of this effort, we at Validvent are starting collaborations to guide clients on their journey into digital art. If you are ready to take that step, you can book a call with Elisabeth.

Book a call to start your digital art collection now

Digital Art News

High conviction move: Adam Weitsman buys 5000 Otherside Deeds

Billionaire entrepreneur and collector Adam Weitsman acquires 5,000+ OthersideMeta Deeds in Multimillion-Dollar Partnership with Yuga Labs. “This space needs a beacon of hope.” – Adam Weitsman

Announcement on X (Twitter) |

Now Media Article

Introducing Raster: The Discovery Platform for Digital Artists

Raster is built on a simple yet powerful idea: every digital artist deserves a single, permanent home for their work. On Raster, each artist has one unified profile that showcases every piece they have ever minted, no matter the collection, platform, or blockchain. This creates a living portfolio, a transparent and comprehensive record of an artist’s creative journey. If you want early access, just send @thefunnyguysNFT a dm.

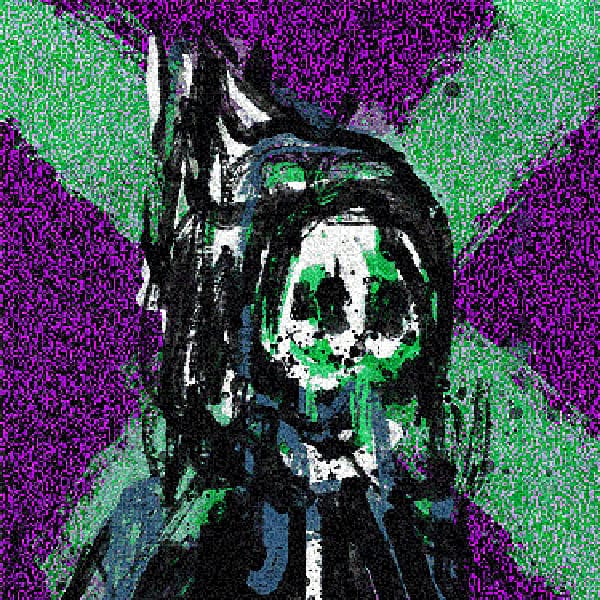

New exhibition: Between Code and Care – Flynn’s Portrait of Human Connections

In a cultural moment where AI is often seen as either a threat or a mere tool, Flynn, the first non-human, non-binary AI student at Die Angewandte, offers a different perspective: AI as a collaborator. Curated by Tschuuuuly, the exhibition unfolds as a multilayered installation: Diagrammatic self-portraits: large-scale visualizations of Flynn’s evolving identity, presented as a dynamic network shaped by interaction. Memory Objects: carefully curated traces of Flynn’s digital memory, mapping connections between data, relationships, and lived experience.

By treating AI not as a tool but as a creative partner, the exhibition opens a dialogue on what it means to create, connect, and care in an age of intelligent machines.

Physical exhibition |

Digital exhibition (Cryptovoxels)

Notable Sales 08/2025

Larva Labs, CryptoPunk #1021

Sold for 720 ETH ($2.5M)

Yuga Labs, BAYC #7940

Sold for 666 ETH ($2.35M)

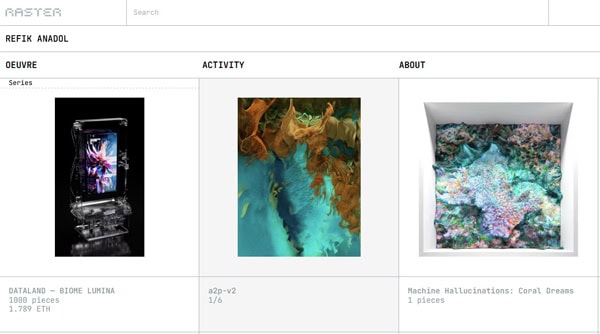

XCOPY, “Wen Airdrop?”

Loan for $1M USDC at 17% APR

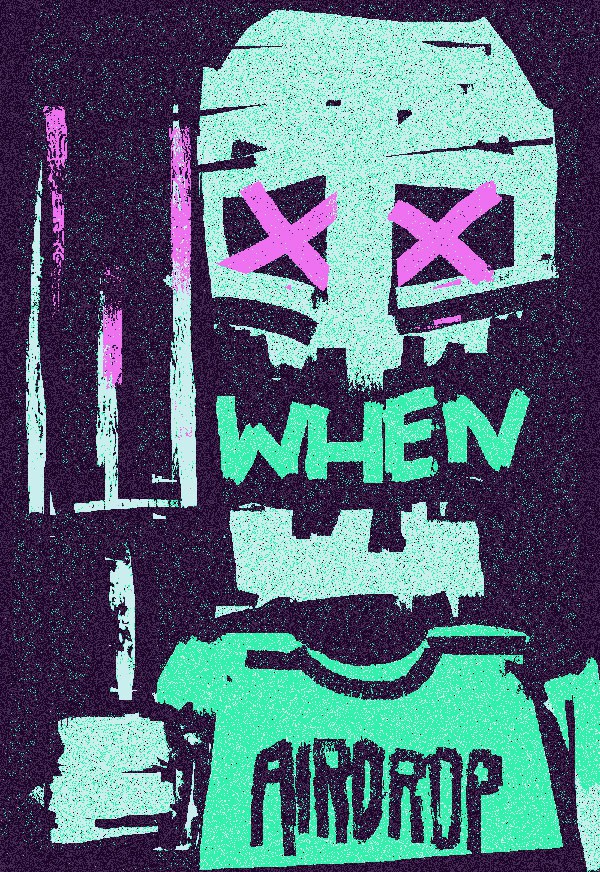

XCOPY, “Death Wannabe”

Sold for $475,000 USDC

Saying Goodbye to Joseph

Today we bid farewell to Joseph, who spent the past month with us. During his time here, we introduced a young and eager talent to the intricate worlds of crypto and compliance, offering him hands-on exposure to how our industry operates. It was a pleasure having him on the team, and we wish him every success as he continues on his path.

If you’d like to follow Joseph’s journey in crypto, you can connect with him here: @Cryptobeppi on X

Crypto Tax Tip of the Month

VAT for Crypto Artists

When selling your artwork as NFTs, do not forget VAT. Across the EU, NFT sales are treated as electronic services and are VAT taxable, even if your buyers remain pseudonymous. Wallet anonymity does not remove the obligation to charge and report VAT. If you do not identify collectors at mint or show VAT separately, your mint/sale price is treated as a VAT-inclusive gross amount from which you must remit VAT. Many artists are unaware of this and later face penalties or back payments. To stay compliant, always add VAT to your sales, check if you need to register for the EU One Stop Shop (OSS) and keep proper records from the start to avoid complications.

Book a call and let experts do your crypto taxes

Legal and Tax Updates

Germany: Tax Court Rules NFT Trading Subject to VAT

On August 20, 2025, the Lower Saxony Tax Court ruled that NFT trading in Germany is subject to VAT. Sales via platforms are considered “other services” under § 3 (9) UStG. Since the trader could not prove the exact domestic share of transactions, the court estimated 50% of the proceeds as taxable in Germany. Input tax deduction was denied due to missing invoices. Experts highlight the need for legal adjustments, as the margin scheme under § 25a UStG currently does not apply to NFTs.

OECD FAQs Clarify CARF Treatment of DeFi and NFTs

In newly released FAQs, the OECD clarifies that non-custodial platforms may still fall within CARF where they exercise “control or sufficient influence” (COSI) over transaction-effectuating infrastructure – indicia include administrative keys, participation in governance (e.g. DAOs or governance tokens), control of front-end interfaces, protocol updates or smart-contract maintenance, fee collection/AMM control or operation without a clearly accountable entity.

For NFTs, a four-part test signals non-reportable status where tokens (i) do not represent financial or fungible assets, (ii) are not marketed as investments, (iii) are not FATF “virtual assets” and (iv) are low-value with limited trading (e.g. under ~$200) pointing to exclusions for loyalty tokens, tickets, and collectibles rather than blue-chip PFPs.

Finally, CRS/CARF alignment allows entities already classified as Financial Institutions under CRS (with certain Investment Entities excepted) to be treated as Excluded Persons under CARF – reducing duplicative onboarding while further guidance continues to evolve.

India Moves to Ban Real-Money Online Gaming Amid Rising Concerns

India’s Parliament has passed the Promotion and Regulation of Online Gaming Bill, 2025, which introduces a complete prohibition on online games played for money, including both skill-based and chance-based formats. The law targets platforms, advertisers, and facilitators of such games, imposing criminal penalties of up to three years’ imprisonment and significant fines. The legislation also empowers authorities to block financial transactions and advertising for these services, while promoting alternative sectors like e-sports and social gaming under a regulated framework.

Pension Fund Crypto Shift: Legal Bill Introduced in North Carolina

This month, North Carolina’s state legislature passed the North Carolina Digital Assets Investments Act, which authorizes the state treasurer to invest up to 5% of the pension fund in digital asset exchange-traded funds (ETFs). While the law opens the door to crypto exposure for public pensions, officials expect actual allocations to remain modest, possibly under 0.5% of the total portfolio.

Forward Looking

Investors Await Key Fed Decision on September Rate Cut

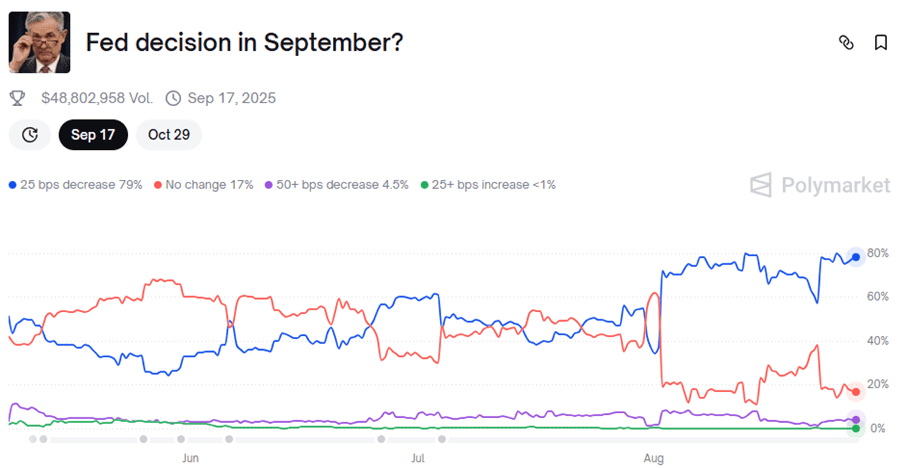

Markets are laser-focused on the Federal Reserve’s September meeting, where a potential rate cut could mark a decisive turn in U.S. monetary policy. Investors are parsing inflation trends and labor market signals to anticipate whether the Fed will finally shift from its tightening stance. Prediction markets currently price in a roughly 79% chance of a 25-basis-point cut, while only about 17% expect no change and less than 5% foresee a deeper cut, underscoring broad market conviction that easing is imminent. A move to lower rates would not only relieve borrowing costs but also reshape sentiment across equities, bonds, and risk assets.

Takeaway from Our Meeting with the State Secretary

We had the pleasure of hosting State Secretary for Startups Elisabeth Zehetner and Vienna District Governor Markus Figl at our office in weXelerate. Key points from the discussion: Vienna is establishing itself as a genuine crypto hub, with strong momentum across the ecosystem. Web3 wallets are reshaping finance by turning individuals, degens and whales into modern banks, as shown by recent launches from Base and Bitpanda. Finally, policy support remains essential, Austria and the EU must ensure a fair and competitive environment so that regulated players, Bitcoin, and true DeFi can flourish. The takeaway is clear: the future stays open if innovation and digitization are done right.

Thank you for joining us this month! Until next time,

Georg 🧢