The Art Market and Its Mechanisms

The art market is one of the most fascinating yet controversial ecosystems of the 21st century. A particularly hot topic is the role of the crypto art market within this system. In this post, we will examine the mechanisms of the traditional art market, highlight the biggest historical and contemporary art sales, and compare them to the crypto art market to assess its relevance. Additionally, we will explore what drives the price of an artwork and how traditional art market mechanisms resemble those of crypto art. Where are the similarities, and where are the differences? And what are the implications for the long-term value of crypto art?

Traditional Art Prices vs. NFT Sales

The price of art has always been heavily dependent on the opinions of a select few. In the past, it was nobles, kings, and the church; today, it is influencers, investors, and key collectors.

Historically, patronage played a central role in the art market. The first high-value documented artwork was The Birth of Venus (1486) by Sandro Botticelli, purchased by the Medici family. Later, artists like Michelangelo, Leonardo da Vinci, and Raphael were commissioned for works worth thousands of ducats (equivalent to hundreds of thousands of dollars today).

In the 20th century, artists like Picasso, Pollock, and Giacometti started selling their works for millions during their lifetimes. More recently, the most expensive first-time sales by living artists have been:

Jean-Michel Basquiat – “Untitled” (1982)

Sold for $19,000 in 1984

Resold for $110.5 million in 2017

Jasper Johns – “False Start” (1959)

Sold for $80 million in 2006

Private sale to Kenneth Griffin

David Hockney – “Portrait of an Artist (Pool with Two Figures)” (1972)

Sold for $90.3 million in 2018 at Christie’s

Jeff Koons – “Rabbit” (1986)

Sold for $91.1 million in 2019

Damien Hirst – “For the Love of God” (2007)

Sold for $100 million

A platinum skull encrusted with 8,601 diamonds

These prices can be directly compared to the biggest NFT sales:

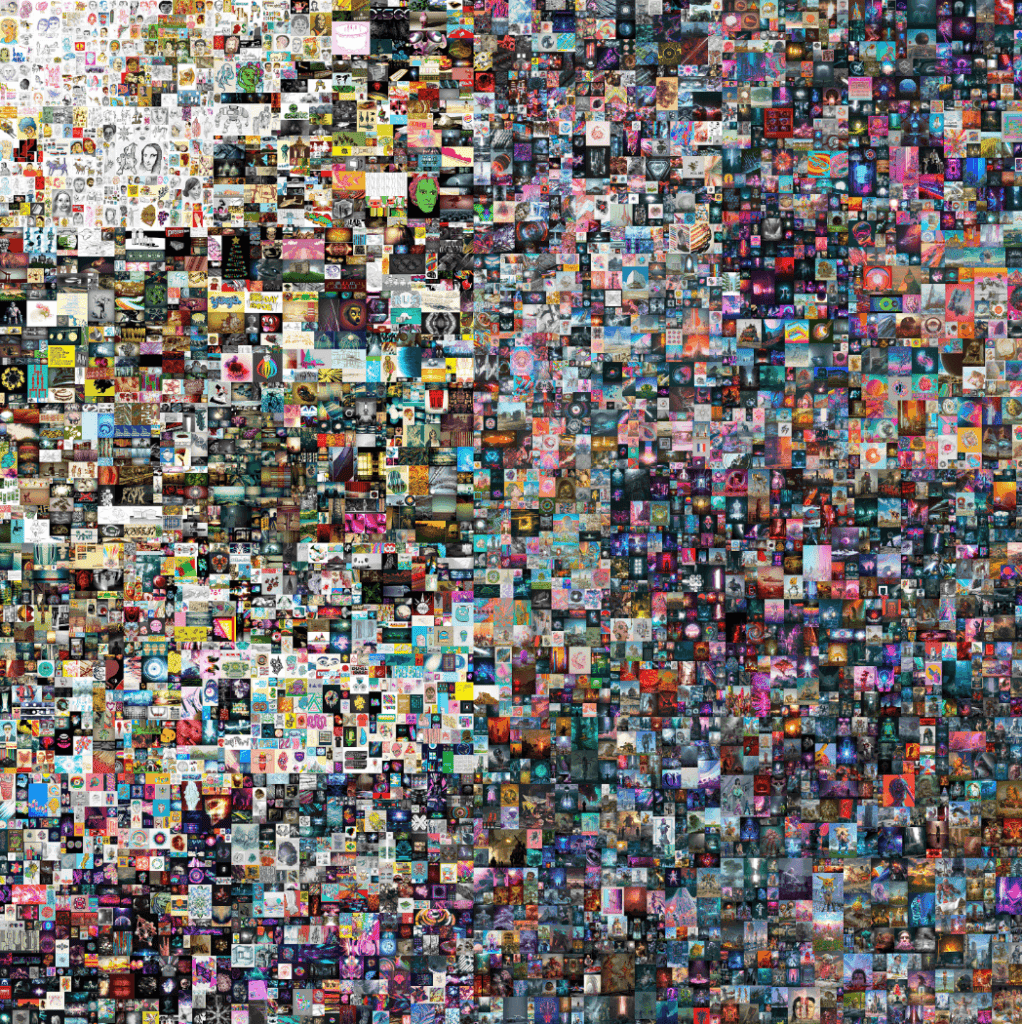

- “Merge” by Pak – $91.8M (2021)

- “Everydays: The First 5000 Days” by Beeple – $69.3M (2021)

- “Clock” by Pak & Julian Assange – $52.7M (2022)

- “HUMAN ONE” by Beeple – $28.9M (2021)

- “CryptoPunk #5822” – $23.7M (2022)

While NFT prices haven’t reached the levels of traditional fine art, the speed at which they have gained market traction is remarkable.

What Drives Art Prices?

The art market is influenced by various factors that determine the value of artworks. Elements such as rarity, provenance, market strategies, and cultural trends play a crucial role in pricing. While the traditional art market is shaped by established institutions and experts, the NFT market offers new, decentralized opportunities for artists and collectors. However, new structures of control and value creation are also emerging in this space. The following section explores the key factors influencing the art market and the differences between traditional and digital art forms.

- Scarcity & Exclusivity – Unique works or limited editions increase value.

- Provenance & History – Art previously owned by famous collectors or museums commands higher prices.

- Artist’s Career & Market Manipulation – Galleries and collectors strategically control supply.

- Speculation & Financial Influence – Art is seen as an investment asset.

- Auction Houses & Record Sales – High sales create market momentum.

- Trends & Cultural Shifts – Art styles gain popularity over time.

- Museum & Biennale Influence – Institutional recognition boosts artist value.

- Emotional & Prestige Value – Collectors pay premium prices for personal reasons.

The Fundamental Differences Between the NFT and Traditional Art Markets

Access & Control

-

- The traditional market is controlled by auction houses and galleries.

- The NFT market is decentralized but still has emerging gatekeepers.

Artist Influence

-

- Traditional artists depend on external validation.

- NFT artists can build direct relationships with their audience.

Liquidity & Price Stability

-

- Traditional art is a long-term asset.

- NFTs are highly volatile and frequently traded.

Traditional Auction Houses and Their Influence on the Digital Art World

For a long time, renowned auction houses such as Christie’s and Sotheby’s dominated the traditional art market, acting as gatekeepers and determining the value of artworks through curated sales and prestigious provenance. However, with the rise of digital art and NFTs, these institutions now face new challenges and opportunities.

By entering the NFT sector, they play a significant role in enhancing the credibility and acceptance of digital art. Their involvement could not only strengthen the connection between traditional collectors and the digital art scene but also promote hybrid art forms that merge digital and physical elements. The following section explores some of the potential developments and impacts of this evolving role of traditional auction houses in the digital art world.

Patrons: The Thought Leaders of Both Markets

Historically, patrons like the Medici family shaped the art world. Today, collectors such as François Pinault and Peggy Guggenheim continue this tradition. In the NFT space, figures like Cozomo de’ Medici and Pablo Rodríguez-Fraile play a similar role by investing millions in digital art.

In the traditional art world, patrons have often been tastemakers and power brokers, using their influence to shape artistic movements and establish new trends. François Pinault, for example, owns Christie’s auction house and one of the largest private art collections in the world, while the Guggenheim family has established multiple art institutions that continue to impact global art culture.

In the NFT market, digital collectors wield similar power. Cozomo de’ Medici, an alias used by a high-profile NFT collector, has invested heavily in digital art and regularly highlights emerging artists on social media, shaping public perception. Pablo Rodríguez-Fraile, an early adopter of NFTs, helped drive Beeple’s rise to prominence by purchasing and reselling his work for millions. These collectors act as curators, using platforms like Twitter, Discord, and blockchain analytics to discover and promote artists. Their influence can propel an unknown artist to fame overnight, mirroring the impact traditional patrons have had for centuries.

As we have seen, the mechanisms of both the traditional and crypto art markets share similarities in valuation, influence, and patronage, yet differ in accessibility, liquidity, and stability. While traditional fine art relies on established institutions and historical prestige, NFTs thrive on digital community engagement and rapid market dynamics.

One of the most striking aspects of NFTs is the high prices they have reached in an incredibly short time. Artists like Beeple and Pak have consistently commanded multi-million-dollar sales, and despite market volatility, many of the most famous NFT artworks have retained their value.

The involvement of major auction houses signals a growing acceptance of digital art, and while NFTs remain volatile, their integration into traditional market structures could bring long-term legitimacy. Whether crypto art represents a passing trend or a true revolution remains to be seen, but one thing is clear: the art world is evolving, and digital art is now an undeniable part of its future.