Aster surges as CZ Returns

Binance’s Ecosystem Revival: CZ’s Return Sparks Strategic BSC Rally

BNB has outperformed the broader crypto market recently, driven by Binance founder Changpeng “CZ” Zhao’s return to public engagement and support for key BSC ecosystem projects. His social media mentions of tokens like ASTER and TWT triggered strong rallies, with ASTER now seen as a potential “perp DEX of Binance” and rival to platforms like Hyperliquid. This renewed activity suggests a strategic pivot by Binance toward on-chain DeFi, with CZ’s endorsements viewed as part of an informal campaign to regain market share.

Tether Seeks $20 Billion Fundraise at $500 Billion Valuation

Tether is reportedly aiming to raise $20 billion in funding at a valuation of $500 billion. If successful, this would position Tether as one of the highest-valued private companies globally, placing it in competition with major tech firms such as OpenAI. The fundraising effort underscores the growing significance of stablecoins and blockchain infrastructure in the broader financial ecosystem.

Plasma Hits $5.4B TVL and Eyes Banking

Plasma’s mainnet launch pulled in about 5.4 to 5.6 billion dollars in total value locked within days, as XPL rewards flowed across well known DeFi stacks like Aave and newer partners such as Veda and Fluid, pulling liquidity onto the chain at speed. The playbook is simple but effective: depositors earn XPL for lending and liquidity programs, which has driven rapid inflows and trading activity. Alongside the DeFi push, the team is rolling out Plasma One, a stablecoin focused neobank with zero fee USDT transfers on chain plus consumer features like a card and savings yields aimed at dollar access in places with shaky local currencies.

Perp DEX Mania: Lighter Points Surge Ahead of Launch

Perpetual DEXs are among the most in-demand sectors in crypto right now, as on-chain derivatives trading continues to pull liquidity away from centralized venues. All eyes are currently on the upcoming launch of Lighter, which has seen intense pre-market interest. Buyers are aggressively acquiring Lighter points, driving their price from around $6 to over $46 per point in secondary markets. This sharp repricing reflects growing speculation around Lighter’s potential to become a major player in the perp DEX space, as well as broader enthusiasm for decentralized trading infrastructure.

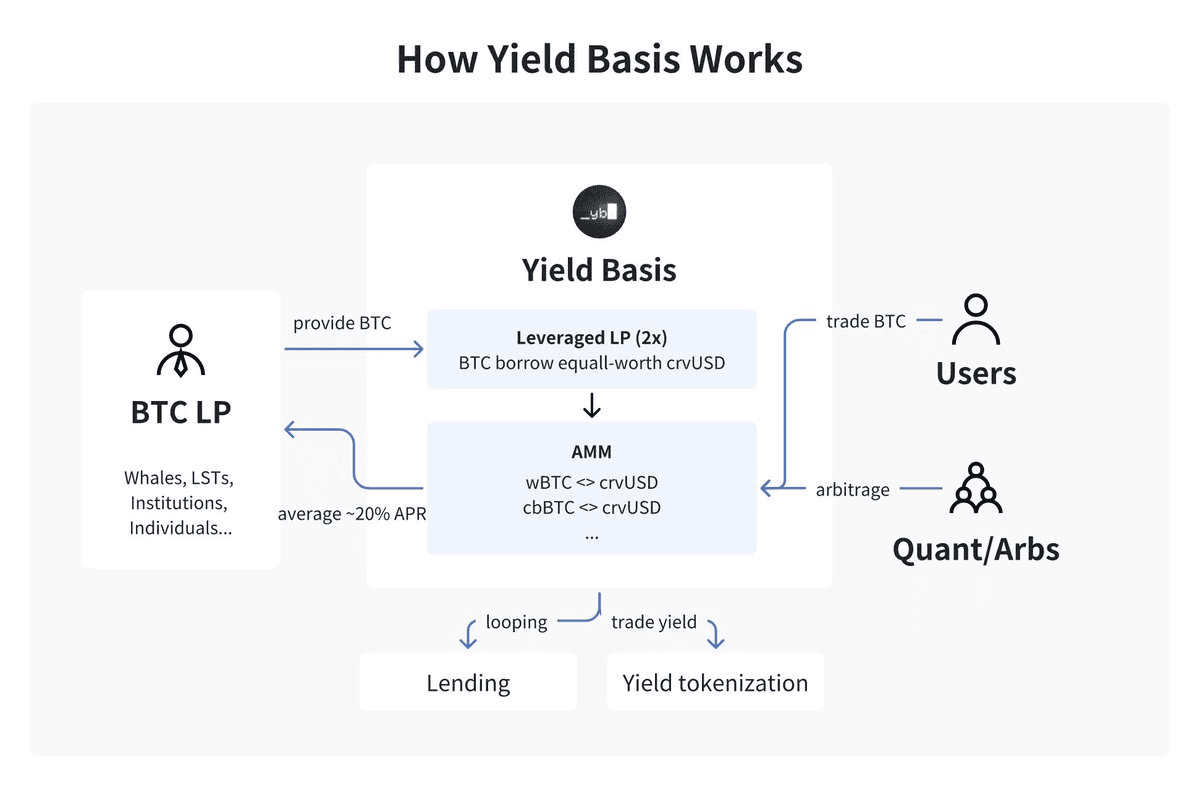

Curve’s Yield Basis Proposal Sparks Debate Amid Kraken Partnership

Curve Finance’s founders new project “Yield Basis” is drawing both excitement and concern within the DeFi community. Designed to eliminate impermanent loss by leveraging user deposits, the proposal has been subject to multiple DAO votes and has sparked debate over potential risks to protocol stability. While some view it as a bold step in yield innovation, others caution that the economic model could introduce unsustainable risks. Adding to the momentum, Kraken has joined as the official launch partner, signaling growing cooperation between centralized and decentralized platforms.

Pump.fun Launches New Fee Model, Triggers Rally in Streamer Tokens

Pump.fun has introduced a dynamic creator fee system as part of its Project Ascend upgrade, linking token creator rewards to market capitalization in an effort to boost long-term project quality and reduce spam tokens. Smaller cap tokens now earn up to 0.95 percent per trade, decreasing to 0.05 percent as market caps rise. The change resulted in over 2 million dollars in creator payouts within 24 hours, far surpassing the previous model and signaling a major shift in content monetization.

Digital Art News

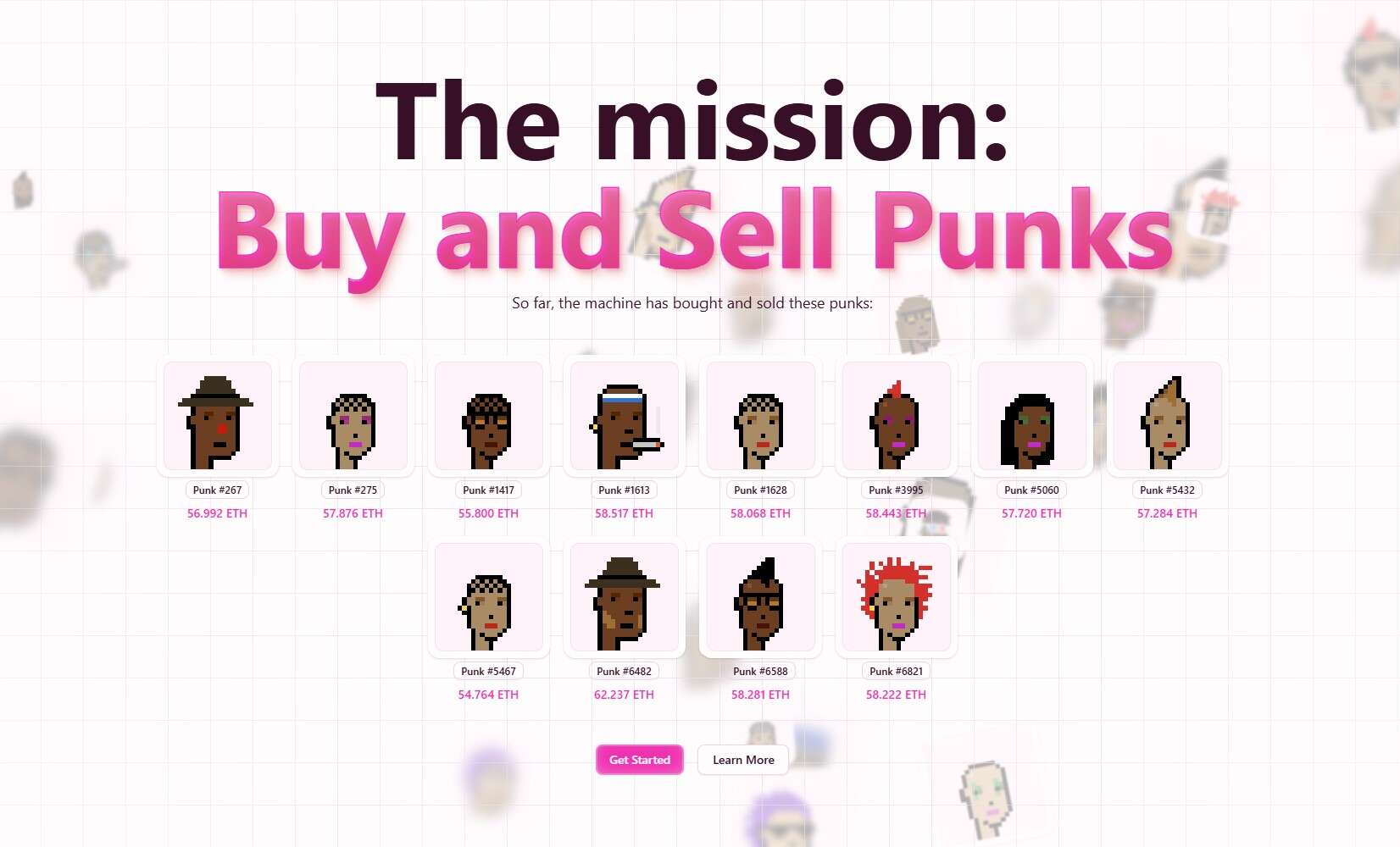

TokenWorks Expands the Perpetual Punk Flywheel

TokenWorks, the team behind the Perpetual Punk Machine™, has just launched a new series of tokenized protocols starting last Month. Since the launch, major NFT collections have been activated with their own buyback mechanism and floors have already started pumping in response. All of these collections are expected to follow the same fee structure as the Punk Machine: 1% of every trade is used to buy back and burn $PNKSTR, creating a compounding flywheel effect.

TokenWorks also announced that they will open their platform and allow the creation of Strategy tokens for every NFT collection soon. This is for now just another experiment but will be soon a permanent driver of liquidity towards NFT collections.

Raster.art is live now

Raster is a new platform to experience tokenized art in its purest form. Each artist has a single profile, a living archive that brings together everything they’ve ever minted, creating a continuous story instead of scattered drops. For artists, it’s visibility and permanence. For collectors, it’s a place of discovery, built to explore the evolving landscape of digital creativity.

When Pixels Learned to Samba

In July, thirteen artists gathered in Rio de Janeiro for the Rio Art Residency, working under the theme “When Pixels Learned to Samba.” Immersed in the city’s vibrant culture, they created side by side, drawing inspiration from Rio’s energy, rhythms, and contrasts. The residency culminates on September 26 with a group exhibition at SuperRare’s Offline Gallery in New York City.

Burst’s Wiener Werkschau

This month marked a major milestone for Burst, who opened their first pop-up/gallery exhibition in Vienna’s gallery district. The show, curated by their manager and close collaborator @Phteven_Nobody, drew an impressive crowd of guests from both the art and web3 worlds. The exhibition runs until October 6, 2025 at Seilerstätte 7, 1010 Vienna.

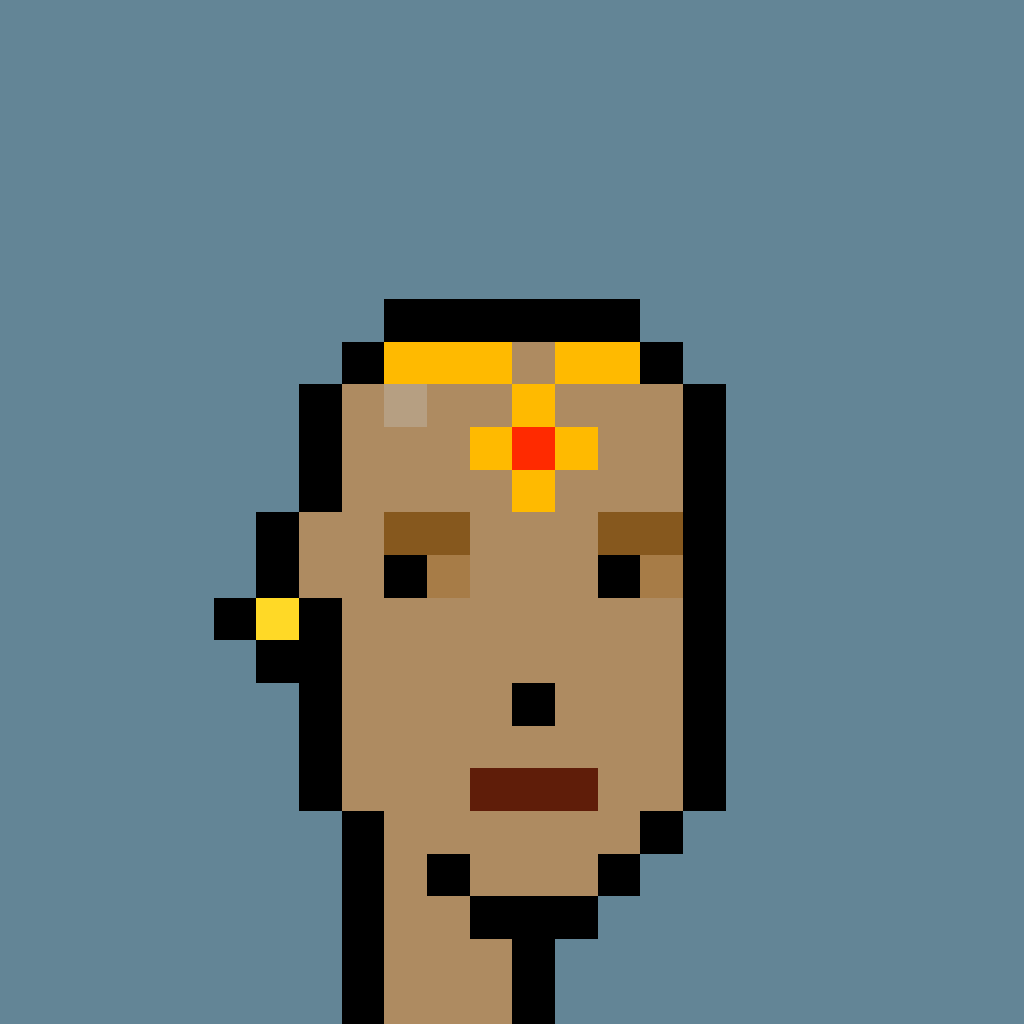

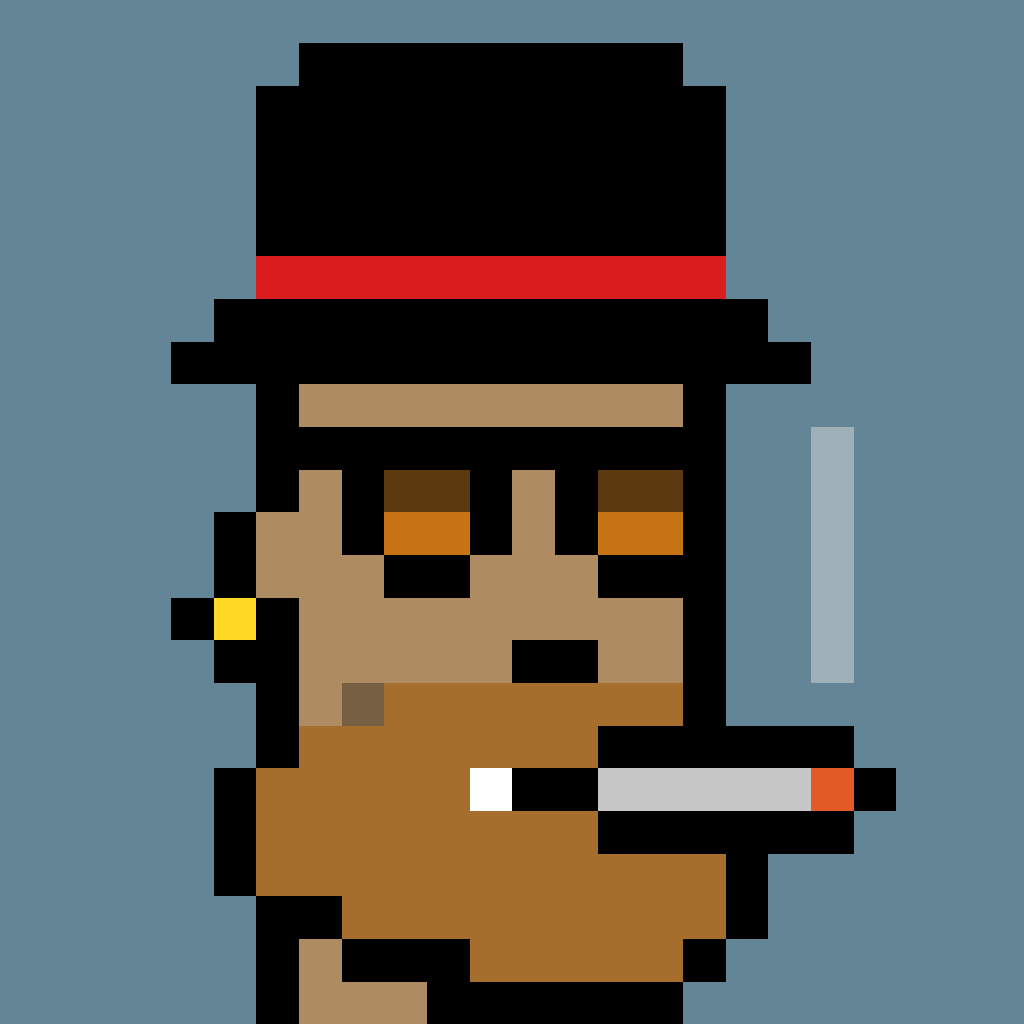

Notable Sales 09/2025

Larva Labs, CryptoPunk #8348

Sold for 100 ETH ($446K)

Larva Labs, CryptoPunk #5898

Refreshed loan of $2.75M USDC

Larva Labs, Autoglyph #213

Sold for 93 ETH ($400K)

XCOPY, “hello admin dm me”

Sold for 70 ETH ($302K)

Crypto Tax Tip of the Month

Crypto Under the Microscope: Act Before They Knock

German tax authorities are intensifying their focus on crypto transactions, with the Financial Crime Office of North Rhine-Westphalia (LBF NRW) already analyzing thousands of cases. If you have not fully declared your crypto activities, it is often wiser to take the initiative and disclose voluntarily before the authorities approach you. According to reports, the information stems from platforms outside of bitcoin.de and covers transaction periods between 2017 and 2022.

Start working with Crypto Tax Experts

Legal and Tax Updates

Major European Banks Launch Euro Stablecoin Initiative

Raiffeisen Bank International (RBI) and eight major European banks have announced plans to issue a euro stablecoin by mid 2026. This is the first time a group of established European banks will jointly launch such a digital currency, aiming to provide a European alternative to the US dominated stablecoin market.

UAE to Roll Out Automatic Crypto Tax Reporting System in 2027

The UAE’s Ministry of Finance has announced that it will implement the Crypto Asset Reporting Framework (CARF) starting in 2027. This move aligns the UAE with global efforts to combat tax evasion by requiring crypto exchanges to report user transactions.

Thank you for joining us this month! Until next time,

Georg 🧢