MEGA (MegaETH) Public Token Sale Launch & Valuation Surge

The upcoming token sale for MegaETH’s MEGA token will offer 5% of the total 10 billion-token supply (i.e., 500 million tokens) via an English auction beginning October 27, starting at a floor fully-diluted valuation (FDV) of just US $1 million and capped at US $999 million. Yet, despite the modest floor, futures contracts on Hyperliquid are implying a valuation for MEGA of around US $5 billion to US $6 billion FDV ahead of the sale. Participation will require bids between US $2,650 and US $186,282 in USDT on the Ethereum mainnet, and U.S. accredited investors must accept a one-year token lock-up to get a 10% discount.

State of Crypto 2025: The Year Crypto Went Mainstream

A new report from Andreessen Horowitz (“a16z”) titled State of Crypto 2025 outlines a turning point for the industry: after years of turbulence, crypto has entered maturity. According to the authors, the total market cap surpassed $4 trillion in 2025, mobile crypto wallet use rose about 20% from the prior year, and major institutions such as BlackRock, JPMorgan Chase, Visa and PayPal all launched or expanded crypto-related services. At the same time, stablecoins processed approximately $46 trillion in transactions (with about $9 trillion on an adjusted basis). Infrastructure advancements have led to major blockchains processing over 3,400 transactions per second, and tokenization of real-world assets has grown nearly fourfold in two years. The report argues that regulatory clarity is now forming, institutional adoption is accelerating, and crypto is increasingly woven into broader financial and technological systems.

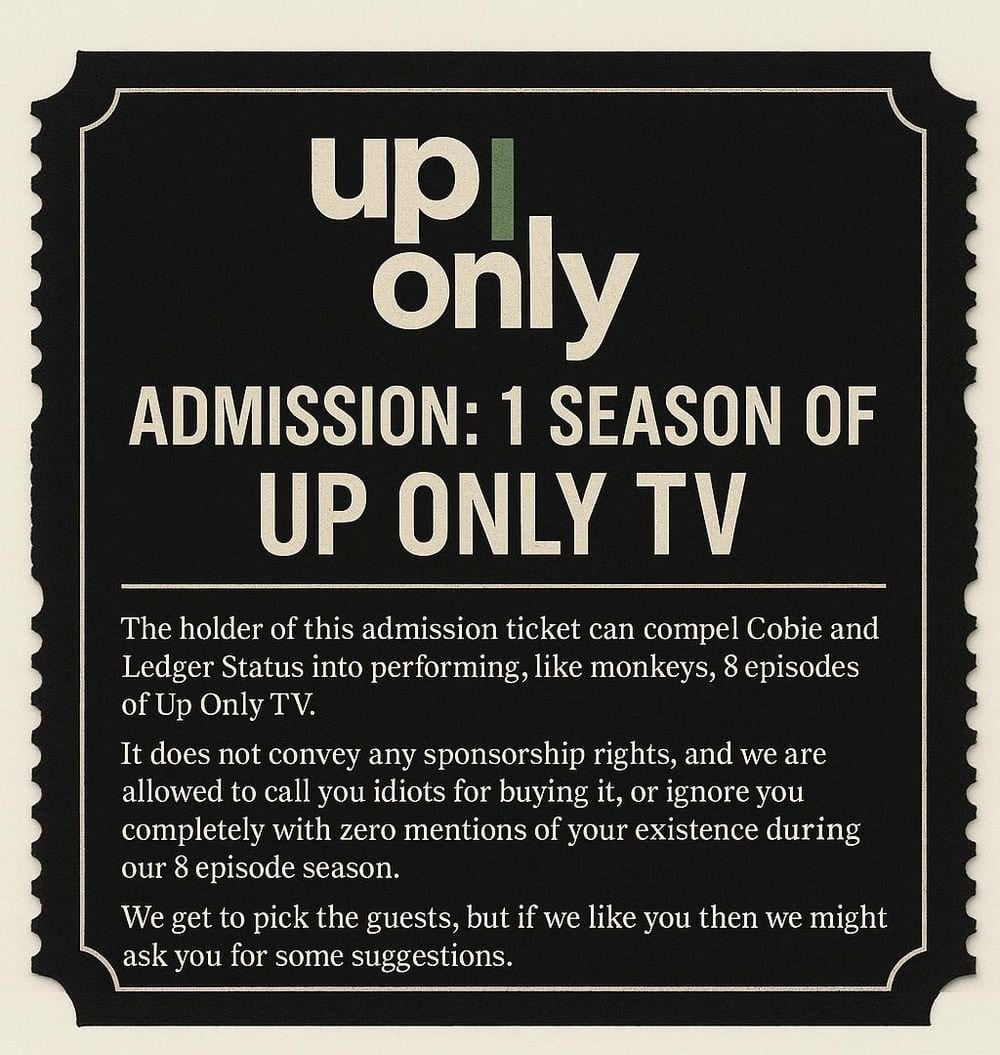

Coinbase Buys Echo and UpOnly NFT to Broaden Web3 Reach

Coinbase has made a bold move in the Web3 space by acquiring both Echo (a crypto-fundraising platform) for about $375 million and the UpOnly NFT (created by crypto influencer Cobie) for $25 million USDC. The UpOnly NFT ownership grants the buyer the right to compel Cobie and his co-host to produce eight new episodes of their once-popular podcast, and the Echo acquisition gives Coinbase access to on-chain capital raising tools that have already facilitated hundreds of deals. These transactions underscore Coinbase’s ambition to expand beyond trading into content, fundraising and tokenised assets.

Historic $19 B Liquidation Spree Shakes Crypto Markets

Friday could have marked one of the most catastrophic days in decentralized finance history. On paper, over $19 billion in liquidations hit across centralized and perpetual decentralized exchanges and the real number was likely even higher. Despite the chaos, on-chain lending markets surprisingly held up, though that stability was more fragile than it appeared. Severe market dislocations saw PAXG trade at $3,600 on Binance, EURC spike to $1.085 on Coinbase, and USDE plunge to $0.65 on Binance. These weren’t true depegs but temporary mispricings. Had those gaps persisted, liquidity would have drained rapidly across DEXs and lending platforms, triggering mass liquidations faster than protocols could react.

On Aave alone, nearly $4.8 billion in positions were at risk, with $180 million in potential penalties. The market avoided disaster thanks to deliberate risk management choices, including pricing USDe at a fixed 1:1 ratio with USDT. The incident highlights the critical weaknesses of traditional price oracles, which rely on secondary market data that may fail for newer asset-backed and mechanism-dependent tokens like USDe, LRTs, PTs, or tokenized RWAs. True oracles must integrate price, proof of reserves, and risk reflecting real-time liquidity, redemption logic, and protocol dependencies.

The episode served as a warning: as DeFi grows to rival traditional finance in scale, it must also match its rigor.

Polymarket Eyes $10 Billion Valuation After $14 Billion in Trading Volume

Polymarket, the leading blockchain-based prediction market, is reportedly targeting a $10 billion valuation as it prepares for a U.S. relaunch backed by a new funding round. The platform has already surpassed $14 billion in all-time trading volume, according to DefiLlama, with monthly volumes recently climbing above $1 billion. The surge reflects growing demand for decentralized prediction markets, where users can trade opinions on elections, crypto trends, and real-world events using on-chain smart contracts.

Digital Art News

Valve Just Broke the Counter-Strike Economy and Wiped $3 Billion

On October 22–23, 2025, Valve released a Counter-Strike 2 (a popular Video game) update allowing players to trade five Covert-tier skins for a Gold-tier knife or gloves, digital in-game items that were previously only available through rare case drops. The change flooded the market, crashing prices by over 50 percent and wiping out $2 to 3 billion in value.

Market trackers confirmed valuations plunged from $6 billion to $3 billion in hours. While new players benefited from easier access, veteran traders called it the “Fat Man update” and saw massive losses.

The crash reignited the debate around digital ownership and centralization. Unlike NFTs, CS2 skins are fully controlled by Valve, players don’t actually own their items. Overnight, a single update erased billions in value, exposing the fragility of centralized digital economies where the publisher holds absolute power. Valve profits from primary sales like case openings, not the secondary market, suggesting the update may have been designed to drive revenue even as players lost money.

In contrast, blockchain assets like NFTs are transparent and truly owned by users, with verifiable, tamper-proof scarcity, and no central authority can rewrite the rules. The CS2 crash is a reminder that in centralized systems companies can win while players lose, but on-chain ownership protects both value and control.

XCOPY’s “The Last Selfie” Sells for $3.27 Million

One of the 10 editions of XCOPY’s digital artwork “The Last Selfie” has sold for $3.27 million to a private collector. Before this sale, the artwork received nine offers, all of which were declined by the previous owners, highlighting the strong demand and attachment collectors have to this piece.

“The Last Selfie” is known for XCOPY’s signature glitchy, animated style and has become one of the most sought-after works in his portfolio. While the details of the transaction platform remain private, the sale underscores the high interest in rare crypto art editions and the active market for XCOPY’s works.

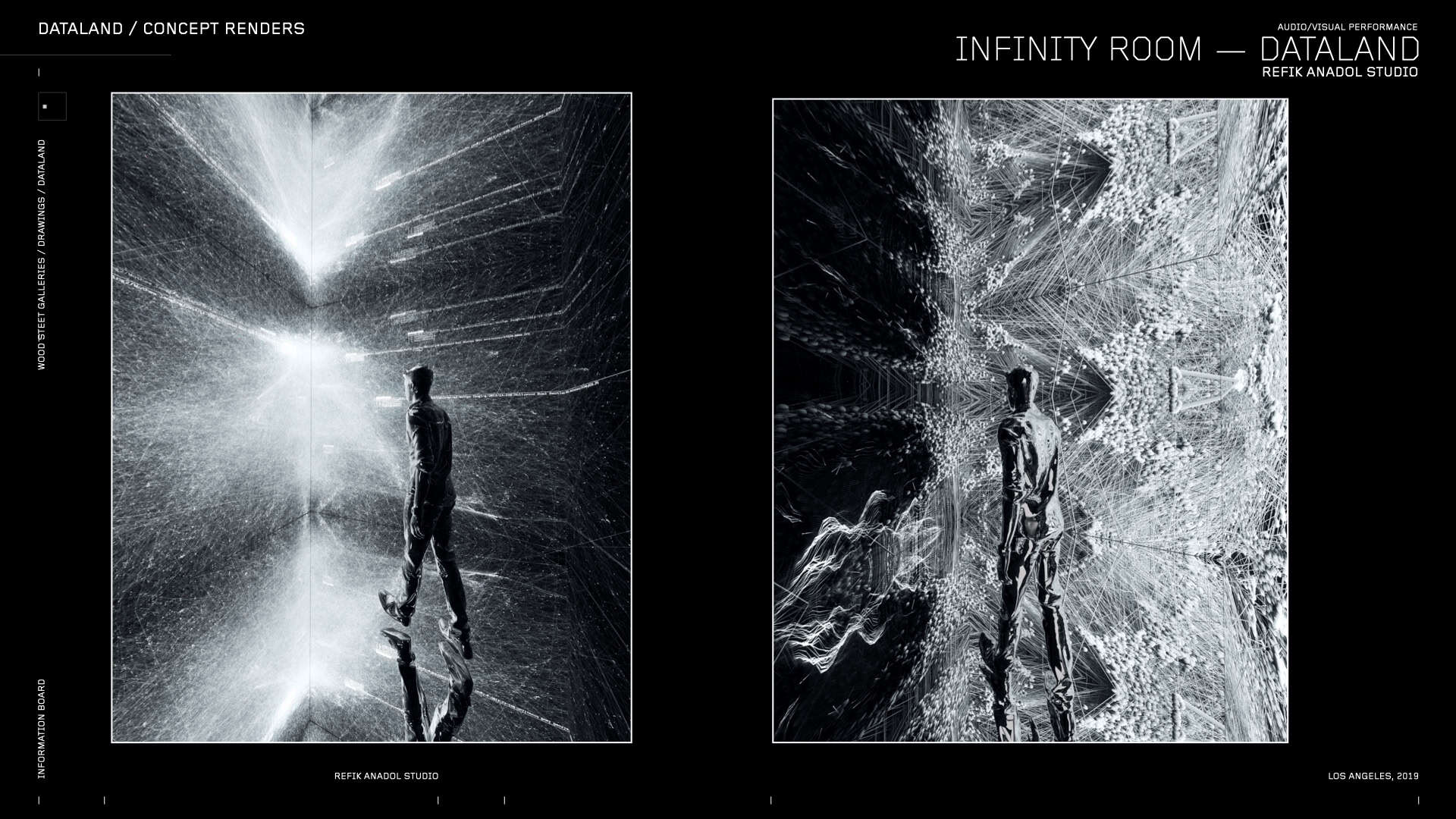

Dataland Popup and Infinity Room Announcement

Last week, the first Dataland Museum popup exhibition took place in Los Angeles. Dataland, a forthcoming museum project by digital artist Refik Anadol, will be the first institution dedicated entirely to AI-based art and research, scheduled to open next year. The popup served as an initial public preview of the museum’s direction, showing selected works and early curatorial concepts.

At the same time, Anadol announced the “Infinity Room”, an immersive installation that will be part of the museum. The installation presents continuously evolving, data-driven visuals that fully surround the visitor. The preview offered a first look into how the museum plans to integrate large-scale immersive environments as a core part of its exhibition format.

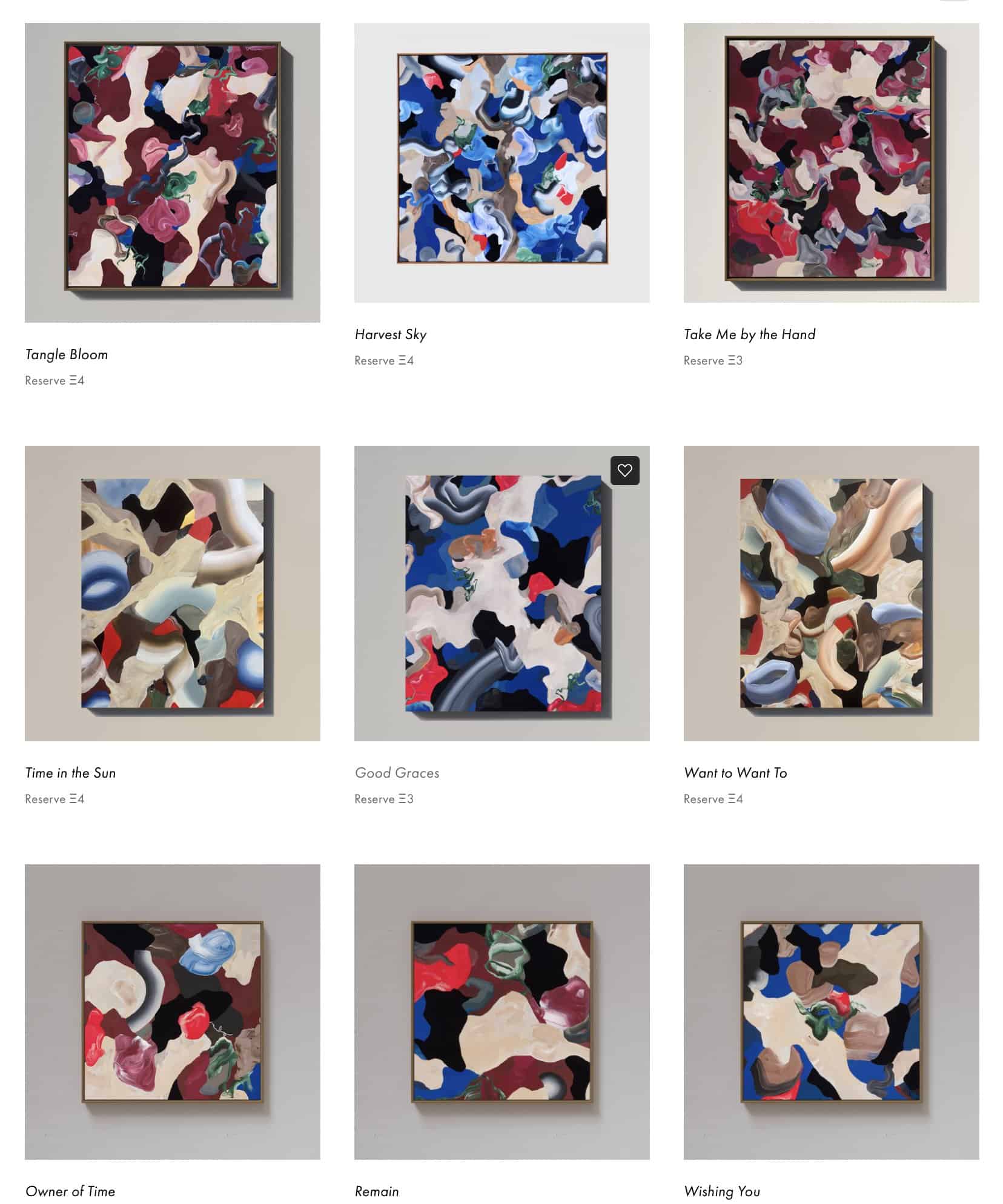

New Release: Harmony >< Tension by ThankYouX

Los Angeles-based artist ThankYouX unveils Harmony >< Tension, a new solo exhibition presented by Fellowship. The show, which opened on October 21, 2025, in Paris during Art Basel week, explores the intersection of physical painting and digital media. The exhibition features a series of paintings paired with digital works, reflecting on the evolving relationship between traditional art forms and digital technology.

An online release of the full collection is scheduled for October 28, 2025.

Expert Advisory for Digital Art

Looking to begin, elevate, or start collecting? Our advisory service connects you with specialists who bring years of expertise in both contemporary and digital art markets. With careful curation and strategic insight, we help you acquire works that combine artistic significance with long-term value. Whether you are taking your first steps or adding to an established portfolio, our guidance ensures that each piece you choose reflects discernment, taste, and lasting relevance.

Start Collecting with Validvent on your Side

Notable Sales 10/2025

Cobie, UPONLY

Sold for $25,000,000

XCOPY, “Last Selfie” 1/10

Sold for 727 ETH ($3.27M)

Larva Labs, CryptoPunk #9205

Sold for 92.5 ETH ($343K)

XCOPY, “Do nothing” 1/15

Sold for 63.8 ETH ($243K)

Crypto Tax Tip of the Month

Austria Plans Broader KESt Withholding for Crypto-Asset Service Provider

The recent Austrian Tax Reform Proposal aims to broaden the role of crypto-asset service providers as withholding agents for the Austrian capital gains tax (“Krypto-KESt”). Since January 1, 2024, platforms like Bitpanda and Coinfinity must withhold KESt on crypto sales against euros for Austrian tax residents, applying only to “new crypto assets” acquired after March 1, 2021. The reform extends this duty to all platforms managing users’ private keys, requiring them to deduct KESt at sale. Platforms must verify acquisition data provided by investors and apply a 50% flat cost basis if details are missing or implausible. This system simplifies compliance for users trading solely on Austrian exchanges, as the withheld tax is final. Those using foreign platforms or DeFi protocols must still declare income manually.

Start working with Crypto Tax Experts

Legal and Tax Updates

Denmark Tightens Platform Reporting Rules Under EU DAC7 & DAC8

Denmark has updated its reporting framework for digital platforms by revising guidance and issuing new legislation to comply with Directive (EU) 2021/514 (DAC7) and Directive (EU) 2023/2226 (DAC8). Key changes include a requirement for platforms to use an EU-wide identification service to verify sellers’ identities and tax residence. Plus, an exemptions from duplicate reporting when platforms utilise the EU ID service, reducing redundant filings.

Registration and deregistration duties now falling squarely on the tax administration, with platforms mandated to register or deregister within eight days when the obligation arises or ceases.

These measures aim to streamline reporting, centralise oversight and ensure that the growing volume of digital-platform activity is properly captured in tax administration systems.

US Senate Eyes Crypto Tax Overhaul with De Minimis, Staking and Reporting Reforms

Lawmakers in the United States Senate have begun a detailed examination of how digital-asset transactions are taxed, focusing on three key areas: exempting everyday crypto payments below a certain threshold, taxing staking rewards only when sold rather than when earned and simplifying reporting requirements established by the 2021 infrastructure law. Both parties agree that the current system is outdated, but debates over thresholds and fairness may slow progress toward reform.

Treasury and IRS Exclude Unrealized Crypto Gains from 15% Corporate Minimum Tax

The U.S. Department of the Treasury and Internal Revenue Service recently issued interim guidance clarifying that corporations can exclude unrealized gains and losses on cryptocurrency and other digital assets when calculating their adjusted financial statement income (AFSI) for the 15% corporate alternative minimum tax (CAMT). This update is particularly significant for companies like MicroStrategy, which had reported billions in unrealized gains on its bitcoin holdings and faced potential tax liabilities based on those paper profits. Under the new relief, these unrealized gains no longer trigger the CAMT, easing the tax pressure on firms with substantial crypto reserves.

HMRC doubles crypto warning letters to nearly 65,000

The UK tax authority sent about 65,000 warning letters to crypto investors in the 2024 to 2025 tax year, up from roughly 27,700 the year before. The letters, often called nudges, urge people to review and correct their filings for gains on activities like selling coins or swapping one token for another. The campaign reflects broader data driven enforcement and comes ahead of new international reporting rules that will expand HMRC’s access to exchange information.

New VAT Interpretation on “Crypto Art” Material Matters

According to the latest guidance (124th Directive of the VAT Committee), European tax authorities now define art based on the material it is made from. As a result, digital artworks including NFTs are classified as made from “other or lower value materials,” such as digital files, and therefore do not qualify as traditional art objects like canvas, oil, marble, film, or wood under the EU VAT Directive. This interpretation means that sales of NFTs or purely digital artworks no longer benefit from the reduced VAT rate that applies to physical art. Instead, they are treated as regular digital services for tax purposes. This update currently reflects the administrative view of the tax authorities aligned with the European Commission’s guidance. It is not yet based on statutory law or a court ruling.

Get Crypto Tax Advice directly from Georg

Thank you for joining us this month! Until next time,

Georg 🧢