Back to Ethereum

Momentum clearly tilted toward Ethereum and core ETH DeFi in July: spot ETH ETFs posted a record single day net inflow of about 727 million dollars on July 16 and kept drawing cash through late July, signaling steady institutional demand, while DeFi’s total value locked climbed to a three year high around 153 billion dollars as activity returned to Ethereum based protocols; the month also closed with a milestone as the network marked its 10 year anniversary on July 30, 2025. A month of celebration for all .eth holders.

Microstrategy 2.0

Small public companies are raising capital to stockpile ETH, LTC, TRUMP, BNB and HYPE, turning their tickers into indirect altcoin exposure and importing crypto volatility into the equity.

SharpLink Gaming ticker SBET scaled into Ethereum in July and reported 360,807 ETH in its treasury with staking live as of July 20th 2025.

Sonnet BioTherapeutics announced an 888 million dollar HYPE token treasury strategy via a business combination.

Freight Technologies announced that they secured up to 20 million dollars to accumulate the Official TRUMP token as a treasury reserve.

MEI Pharma disclosed a 100 million dollar private placement to begin a Litecoin treasury strategy, claiming first mover status among listed firms.

Pumpfun: The Sale and the Downfall

Pump Fun the end of an Era? On July 12, 2025 Pump fun held their sale priced at 0.004 dollars per token, targeting 150 billion tokens for sale and 4 billion FDV. This is one of the biggest public raises in crypto history, even discounting the already prefilled presale round at the same terms. Pumpfun is sitting on more than 2 billion USDC with what they raised and the fees that they have earned.

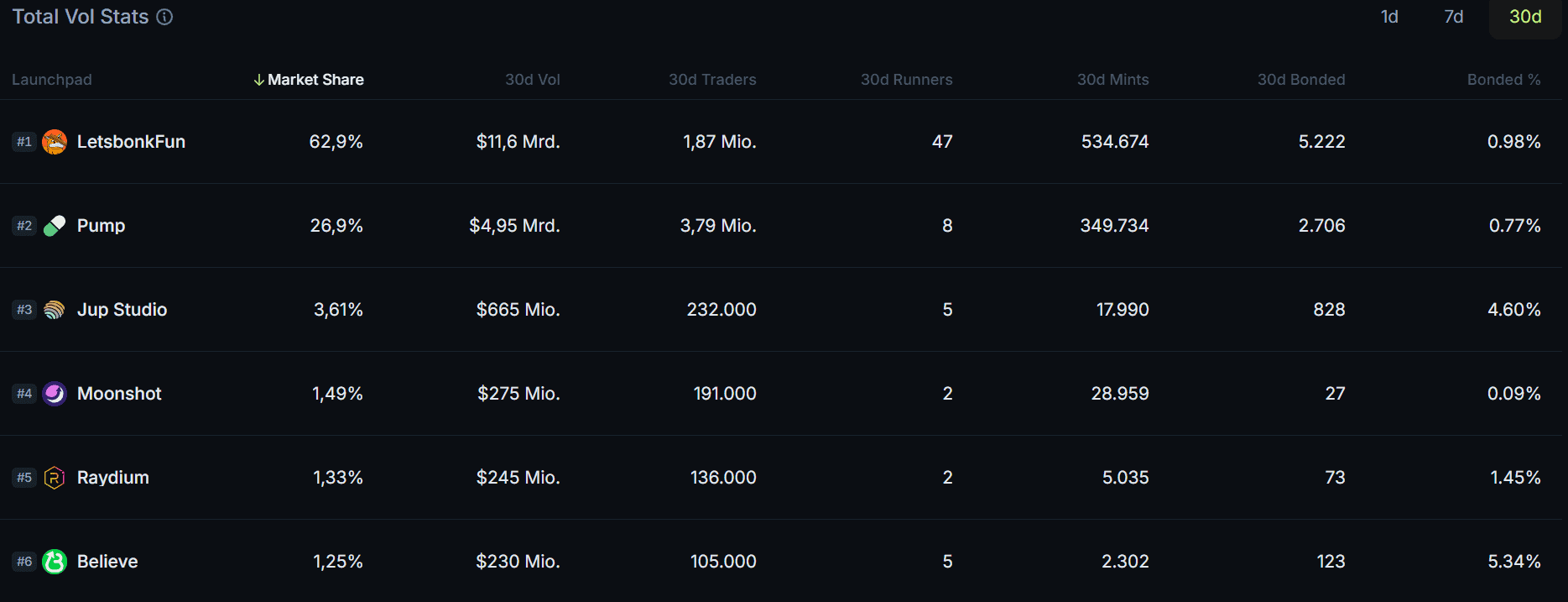

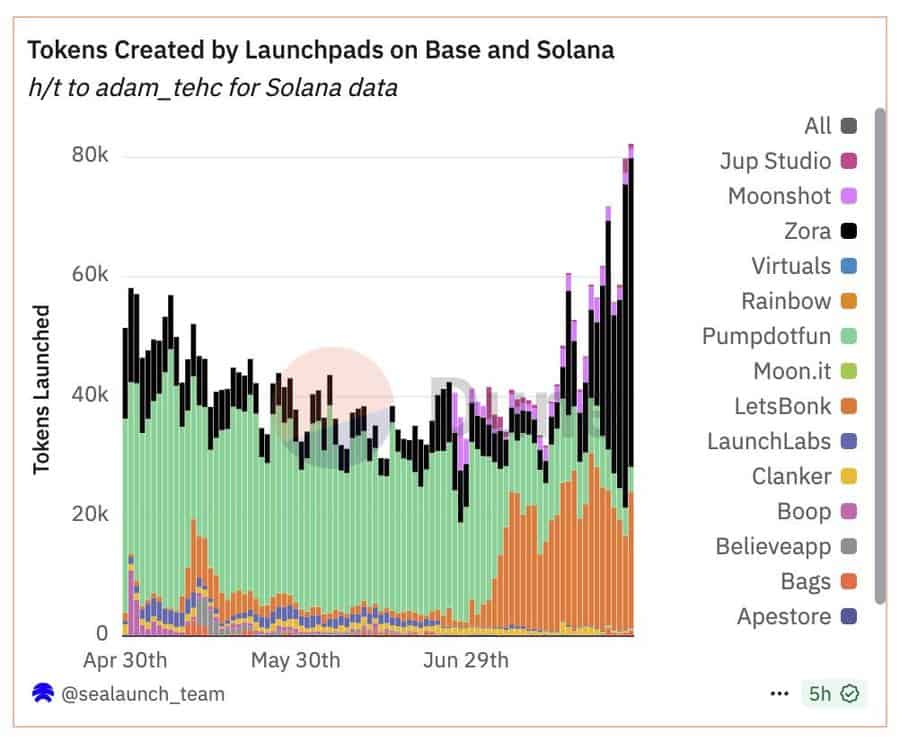

Marketshare shift to LetsBONK and other Competitors

Multiple reads of Dune and Jupiter data show LetsBONK overtaking Pumpfun in early to mid July, then widening the lead through late July. The Pumpfun token seems to reflect these changes in market share as it still trades lower than the presale price. Will they use these 2 billion which they have to try to get back marketshare, or was this the final extraction? The announced airdrop also hasn’t happened yet and Alon disclosed that it won’t happen “anytime soon”.

Solana VS Base

Solana Founder Commentary on Memes and NFTs

Anatoly Yakovenko called memecoins and NFTs “digital slop”, sparking a widely covered exchange with Jesse Pollak. This is especially controversial because the extraordinary performance of meme coins on Solana in the past few years constitutes the main activity on the chain.

Opportunity: The Everything App

Base Announces the Base App

The Base app is the new consumer app that bundles social posting, chat, mini apps, trading, and payments. It sits with Base Account for identity and Base Pay for USDC checkout. The idea is that Base app will be a simple update of the already widely used Coinbase app. This unlocks more than 20 million potential user and exposes them to the everything app. Integrated liquidity farming on USDC is placed as an incentiviser with base pay to potentially rival centralized payments providers, such as cashapp or venmo. On the new Base app, Farcaster and Zora are inherently integrated into a social feed. Every post is a token and the idea is to give back money from a trillion dollar industry (social media) into the hands of users. Will this end like friendtech with a short spike in usage followed by disinterest, or does the exposure to millions of Coinbase wallet app user and support from Coinbase create the first successful app in this category?

ETA and public access

As of July 29, 2025, Base says that the app is still in beta, with waitlist access opening in daily waves.

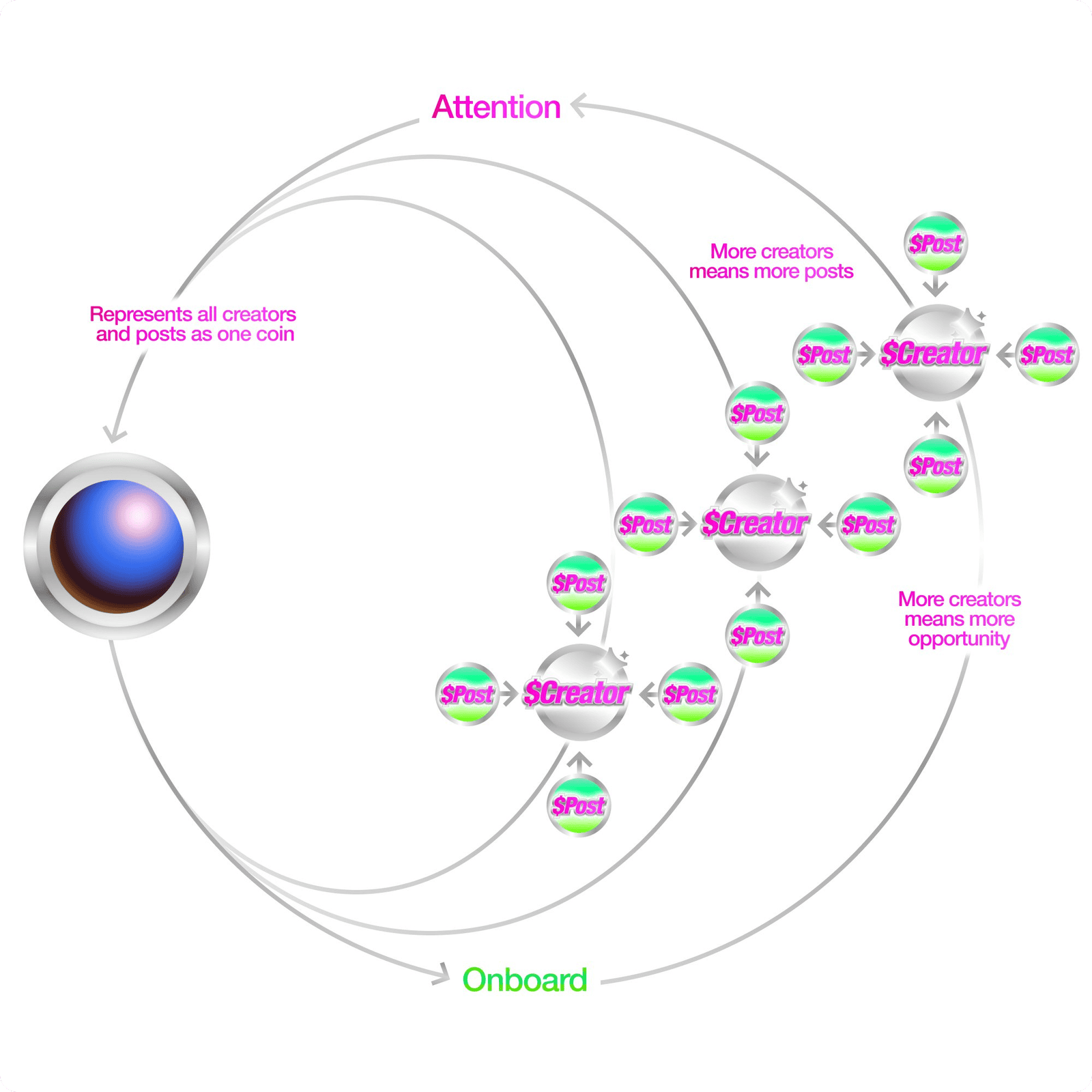

Zora – The Flywheel

Inside the Base app, Zora functions as the creation stack that turns social attention into real launches by making it easy for creators to mint, list, and grow new tokens, and then to feed that activity back into discovery and trading loops inside the app. The result is visible across the ecosystem.

More tokens are launching on Base than on any other network, a shift helped by Base hype and by the catastrophic post-sale performance of Pumpfun that nudged market share away from Solana toward Base. The tone also echoes the earlier AI agent season on Base, when Virtuals and its flywheel pulled in users and liquidity and then kept compounding with each new drop. If Zora continues to ship successful tokens inside the app, that same compounding dynamic could sustain future runs.

Start Earning on Your Stablecoins

Digital Art News

Recent Surge in Digital Art on the Blockchain

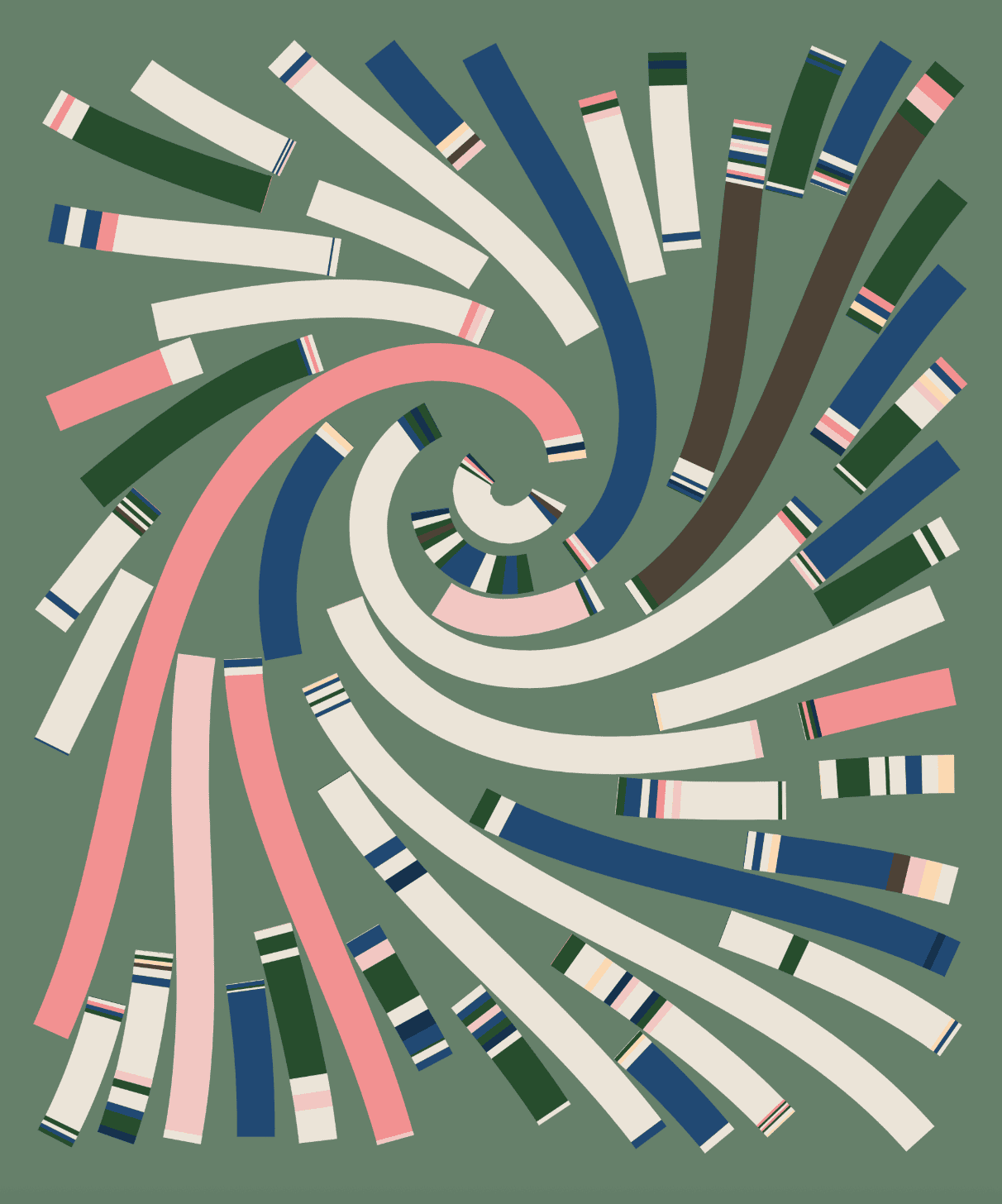

In the past few weeks, digital art trading on the blockchain surged. Larva Labs’ CryptoPunks led with a volume of 19K ETH (~$67.3M), making it the top-selling collection. The highest sale was Punk #5577 for $5.15M. Other blue-chip collections also showed strong activity: Chromie Squiggles’ floor price rose from 3.8 to 5.4 ETH with a volume of 50–60 ETH ($180K-$200K). Fidenza by Tyler Hobbs topped with 68.3K ETH ($260M) volume, floor price increasing from 30 to 44 ETH, and the highest sale at 91 ETH (Fidenza #397).

Autoglyphs holds the highest floor price at 96.5 ETH, with seven sales last month and a top sale of around $380K, despite lower overall volume. Other notable activity came from older blue-chip collections like Ringers, Meridians, Memories of Qilin, as well as Skulls of Luci, Winds of Yawanawa, Rarepepe, Terraforms, Grifters, Gigachad, PXL DEX, Anticyclone, Great Color Study, and Gazers.

Recent Surge in PFP Collections

There has been a significant rise in trading volumes and price increases in Profile Picture (PFP) collections. For instance:

- Moonbirds – Since acquisition by Spencer from Yuga Labs, the floor price surged from 0.7 ETH to 2.72 ETH, currently stabilizing at 2.0 ETH.

- Hashmasks by Hackatao saw a floor price increase from 0.04 ETH to 0.25 ETH, currently at 0.21 ETH.

- The OG project Mooncats jumped from 0.13 ETH to 0.4 ETH, with a current floor price of 0.33 ETH.

- Classic PFP collections such as Pudgy Penguins, Bored Apes, Doodles, Clone X, and World of Women also experienced price pumps.

It’s important to note that these surges correlate closely with the recent increase in the price of Ethereum.

Toledo Museum of Modern Art Exhibition: Infinite images

Last month, the Toledo Museum of Art in Ohio opened Infinite Images: The Art of Algorithms – the first major exhibition in a traditional museum dedicated to generative, blockchain-based digital art and its history. Curated by Julia Kaganskiy, the show presents over 50 works by 24 artists, ranging from pioneers like Josef Albers and Vera Molnár to contemporary figures such as Tyler Hobbs, Sofia Crespo, and Larva Labs.

The exhibition explores rule-based systems, chance, and algorithmic aesthetics, connecting early plotter drawings to blockchain-minted works. By placing on-chain generative art in dialogue with mid-20th-century algorithmic practices, Infinite Images reframes the field’s history – highlighting how blockchain introduces new forms of authorship and distribution. Digital art is presented not as static imagery, but as code-based processes activated through minting and interaction.

With this exhibition, the Toledo Museum marks a major step toward institutional recognition of digital-native art, affirming its conceptual and material relevance within the broader art-historical canon.

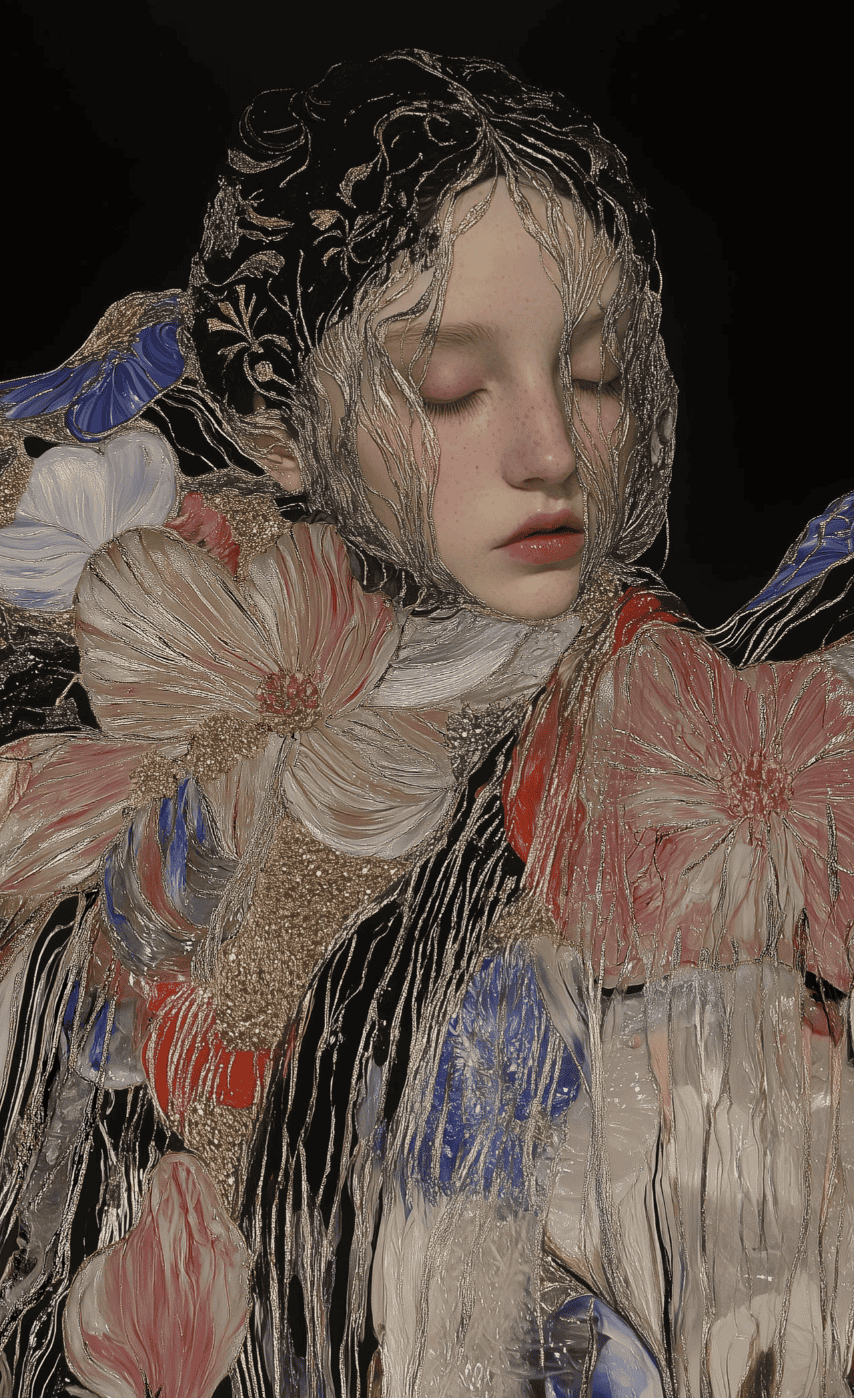

New Collection Release: Claire Silver’s Daydreams Sells Out Within Minutes

AI artist Claire Silver has released Daydreams, a limited edition pairing a physical print with a unique blockchain based digital artwork from her ongoing series in this house. The central piece, Daydreamer, draws on Silver’s personal story of illness and healing through imagination. Each NFT features a one-of-a-kind composition and a title generated by AI – blending emotion and code in a recursive process that teaches AI how to “dream.” Inspired by the myth of Orpheus, the collection reflects on how machines process memory, longing, and transformation. Released via Avant Arte, all 40 editions sold out almost instantly.

Claire Silver in Vienna

The AI artist Claire Silver is currently exhibited at Designforum Vienna. The new exhibition AND, OR, OR NOT explores the creative collaboration between humans and machines. Here, AI is not merely a tool, but a true co-creator. The show features works by international artists, including Claire Silver – one of the most celebrated AI artists within the crypto art scene. “This exhibition is not an archive of the existing, but a springboard into the unknown […]”

Notable Sales 07/2025

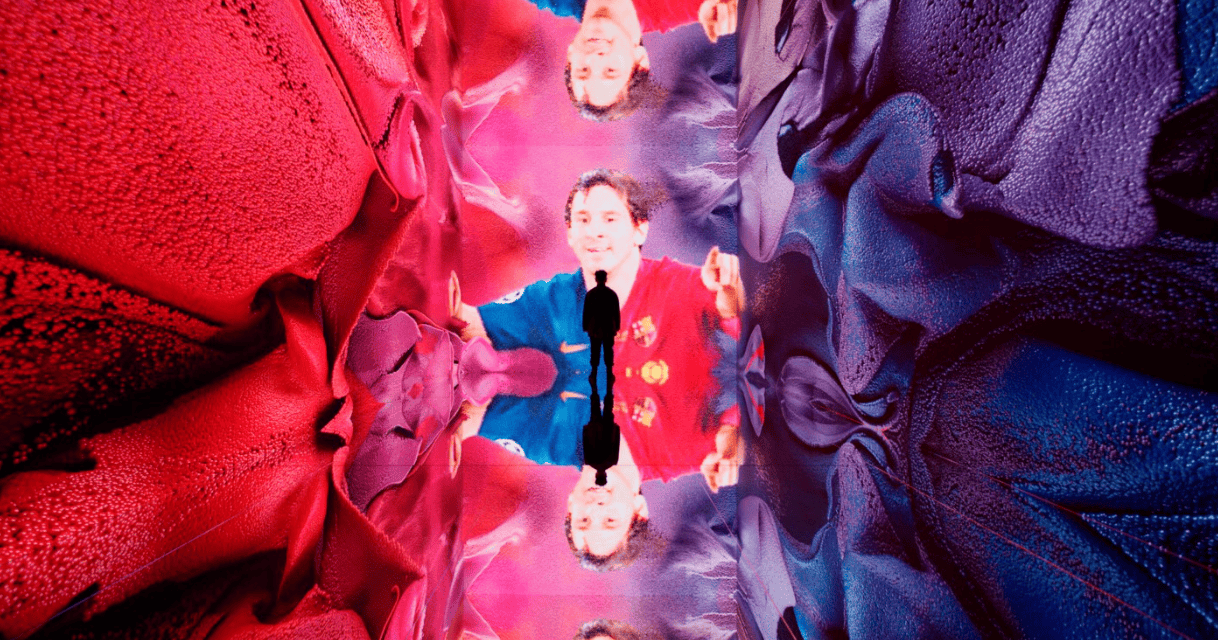

LIVING MEMORY: MESSI

Sold for $1.865M

Refik Anadol

CRYPTOPUNKS #5577

Sold for 250 ETH

Larva Labs

FIDENZA #396

Sold for 91 ETH

Tyler Hobbs

AUTOGLYPH #157

Sold for 380K USDC

Larva Labs

Start your Digital Art Journey with Validvent

Legal and Tax Updates

Strengthening American Leadership in Digital Financial Technology

The White House has released a report, prepared by the President’s Working Group on Digital Asset Markets under Executive Order 14178, that lays out the administration’s strategy for digital assets and blockchain. It backs lawful use of open public blockchains including self-custody, mining, validating, and uncensored transactions, seeks technology-neutral rules with clear jurisdictional lines, and promotes the dollar through dollar-backed-stablecoins. The report rejects a US central bank digital currency, and maps recommendations across market structure, banking access, payments and stablecoins, illicit finance controls, and taxation and reporting. Overall, it aims to provide regulatory clarity while encouraging innovation and safeguarding financial stability.

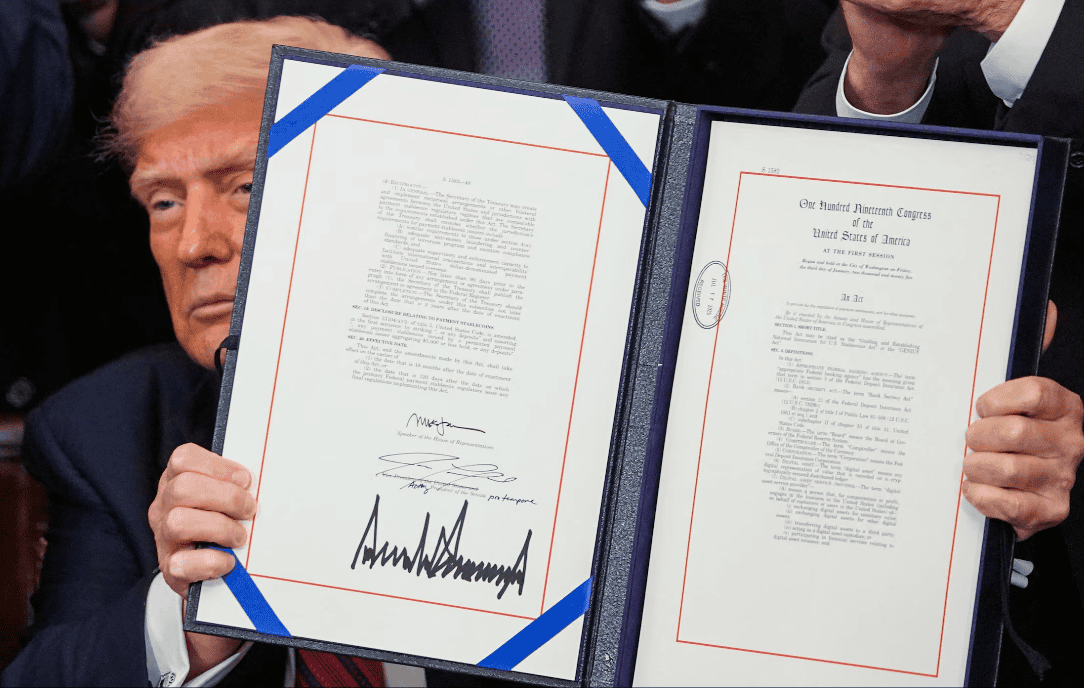

GENIUS Act

On July 18, the U.S. Guiding and Establishing National Innovation for U.S. Stablecoins Act of 2025 was passed and signed, creating the first federal framework for payment stablecoin issuers. Reuters’ Breakingviews column summarize core provisions and likely Fed frictions.

DAC8: Germany Moves Forward

On July 4, 2025, the German Ministry of Finance published a revised draft bill to implement the EU DAC8 Directive (2023/2226), which focuses on strengthening tax transparency in the crypto sector. The proposed legislation introduces new due diligence and reporting obligations for crypto-asset service providers (CASPs). It establishes the framework for the automatic exchange of user and transaction data across EU member states, aiming to close regulatory gaps and combat tax evasion in the digital asset space.

In addition to introducing this new law, the draft also proposes amendments to several existing statues, inculding the EU Administrative Assistance Act and the Platform Tax Transparency Act. The consultation period for the draft legislation closed on July 14, 2025.

Germany intends to implement the law by January 1, 2026, in line with the EU-wide transposition deadline of December 31, 2025.

CALL to ACTION: If you run or use crypto platforms in the EU, get ready for mandatory transparency or move all-in DeFi.

USDG by Paxos

Stablecoin competition broadened in Europe. USDG, issued by Paxos and backed by a consortium that includes Robinhood and Kraken, launched in the EU on July 1 with a MiCA‑compliant posture.

US: IRS enforcement

The IRS is stepping up crypto enforcement in 2025, with taxpayers receiving Letter 6173, Letter 6174 or Letter 6174-A about digital asset reporting and CP2000 mismatch notices, while the Supreme Court on June 30, 2025 declined to hear the Coinbase user data case, which leaves in place the IRS’s ability to obtain exchange records; combined with exchange data and analytics, that means if you traded, staked, or used foreign platforms you should get compliant now.

IRS Virtual Currency Letter |

IRS CP2000

Cryptotax Tip of the Month

$VSN Merge (Austria friendly)

Keep your $BEST and $PAN tax-free after the $VSN merge by preserving the old asset status. To do this, transfer your $VSN to a non-Austrian broker, such as Kraken. Do not move your tokens to Bitpanda, Bybit, Coinfinity, 21bitcoin, or Trade Republic, as these providers may apply automatic tax withholding based on Austrian tax authority guidance. On Kraken, you can continue to trade crypto-to-crypto or cash out to fiat without prematurely ending your tax-free holding period. When filing your 2025 tax return, be sure to include your full transaction history, including the transfer of tokens, and attach a legal opinion that confirms preservation of the old asset status. This strategy aims to achieve zero-percent crypto tax by maintaining the long-term holding benefit while avoiding Austrian brokers that might trigger taxable events. If you want help preparing the necessary paperwork or securing a legal opinion, feel free to book a call with the link below.

Get the Best Tax Representative for Your Crypto Taxes

Thank you for joining us this month!

Until next time,

Georg 🧢